BRI BOARD OF DIRECTORS

The Benefit Resources, Inc. (BRI) Board of Directors report to the 42nd General Assembly of its work during 2021-2022, plus recommendations for consideration by the Assembly.

Use these quicklinks to navigate to a specific section of this report:

Summary of Work

Summary of Recommendations

Work of the Committee

Recommendations (Detailed)

Committee Members

Meeting Dates

Randy Shaneyfelt

Chairman

RE, Presbytery of the Great Plains

SUMMARY OF WORK

1. Health and Wellness: Our members and their churches experienced a modest 2% premium price increase in 2022, well below most other employer-provided healthcare plans.

2. Retirement: With growth in participation, continued contributions by our church employers, and members and market appreciation, our plan has grown to more than $200 million (January ‘21).

3. General Operations and Administration: BRI is well-capitalized and holds reserves and stop-loss insurance for unexpected medical claims.

4. Participation Overview: All full-time clergy and staff at EPC churches and EPC-associated ministries are eligible to participate in the benefit plans sponsored by BRI. Higher participation advantages all members and their sponsoring churches.

5. Medical/Rx Benefits: We understand that member EPC churches and staff have varying needs when it comes to medical coverage, that’s why we offer five plans: Platinum, Gold, Silver PPO Plans plus Gold and Bronze High-Deductible/Savings Plan options. These plans offer a wide spectrum of premium and participant cost-sharing levels.

6. Member Health-Wellness and Member Care Focus: BRI has implemented the Livongo Whole Person Health program to coach and provide practical resources to those with diabetes, pre-diabetes, and high blood pressure. BRI also added a Nurse Health Coaching program to provide education and support to participants with other conditions such as chronic pain, high cholesterol, asthma, COPD, heart disease, and kidney disease.

7. Life, Vision, and Dental Insurances: Life and Long-Term Disability insurances are provided by The Hartford. The plan needed an 8% rate increase and changes to the deductible and co-pays that increased out-of-pocket expenses for participants. Enhancements were made adding a Virtual Consult dentistry tool and BrushSmart oral wellness program.

8. EPC Retirement Plan: Effective August 23, 2021, the Board directed our members’ balances and future contributions in Target Date Funds to be switched from Vanguard funds to Fidelity funds. The Board concluded that Fidelity Target Date Funds were very similar to funds offered by Vanguard in investment risk profile, management, and long-term returns but now have lower management fees.

RECOMMENDATIONS

42-23 That ordained ministers drawing retirement income from the EPC 403(b)(9) Defined Contribution Retirement Plan be allowed to designate up to 100% of their retirement income for housing allowance as permitted by applicable regulations adopted pursuant to the Internal Revenue Code.

WORK OF THE COMMITTEE

EPC BRI’s vision is to improve the physical and financial well-being of pastors, their families, and eligible lay employees in Christian ministry that they may be better equipped to fulfill their callings. Our mission encourages plan participants to improve their health, wellness, and retirement security.

To fulfill our mission, we provide a complete suite of benefits that meet participants’ needs at a competitive cost and are portable, convenient, and consistent with EPC values and EPC BRI fiduciary responsibilities. Our goal is to accomplish this mission and vision by providing competitive benefit plans, create plan stability, encourage wellness programs, and provide flexible and above-benchmark-performing retirement plans—all through a structure of efficient and cost-effective premiums and expenses. We also seek to create high member support, participation, and satisfaction.

In pursuing the mission of EPC Benefit Resources, Inc., we humbly submit the following report of the plans, activities, and results for the last year:

HEALTH AND WELLNESS

• Our members and their churches experienced a modest 2% premium price increase in 2022, well below most other employer-provided healthcare plans.

• Effective January 1, 2022, the EPC Plan switched to Meritain Health as the administrator of our 30,000 annual member medical claims, and to the Aetna network of healthcare providers. 96% of the doctors, labs, clinics, and hospitals in our previous Blue Cross network are members of the Aetna network.

• The wellness profile of EPC members reveals health status concerns that impact the joy of life and risk of future medical claim cost. Specific services from Meritain have already been implemented to assist our members experiencing these conditions.

• We must note that some EPC churches still do not participate in the medical plan. As described further in this report, our EPC medical plan provides excellent coverage through a top-tier, nationwide network of quality hospitals and providers. As a self-insured plan, the premiums our churches and members pay are used exclusively to provide medical care for our members and the plans offered reflect our values as Christians. In effect, EPC member congregations are a sharing network for each other’s medical costs. We strongly encourage all churches to consider participating to support one another in ministry.

RETIREMENT

• This Plan is a 403(b)(9) Defined Contribution church plan, and ordained pastors retain the ability to claim up to 100% of their annual retirement withdrawals as income-tax-free Housing Allowance, even into retirement.

• With growth in participation, continued contributions by our church employers and members and market appreciation, our plan has grown to more than $200 million (January ‘21).

• An EPC BRI fee increase of $18 per account annually to cover increasing liability insurance, investment consultation, and overhead costs was instituted for 2022. For most accounts this increase was more than offset by reductions in the asset-based fees charge by Fidelity and the investment fund managers.

• Many members took advantage of free consultation with Fidelity representatives and of the educational webinars and other financial planning tools offered through BRI and available on their personal account login on Fidelity’s NetBenefits webpage.

GENERAL OPERATIONS AND ADMINISTRATION

• EPC Benefit Resources, Inc., financial statements are audited annually by independent accounting firm Batts, Morrison, Wales, and Lee, Certified Public Accountants. The audited statements are presented to the BRI Board and the Office of the General Assembly.

• The EPC BRI nine-member Board is comprised of EPC church members, including pastors and professionals from multiple disciplines. BRI’s Executive Director has 27 years of experience managing benefit programs and associated financial risks.

• BRI is well-capitalized and holds reserves and stop-loss insurance for unexpected medical claims.

• Advice and counsel is provided through membership in the Church Benefit Association, Church Alliance, and use of Legal Counsel, Actuary, and Consultants specializing in Retirement Plan and Benefits Administration.

• The BRI Office and the Office of the Stated Clerk often receive inquiries regarding the requirements for participation in EPC Benefit Plans as mandated by the Acts of Assembly. The Acts clearly express the intent that benefits-eligible EPC pastors and staff should be provided with medical coverage through the denominational medical plan. Although there are many Acts that reference EPC medical and retirement programs, key Acts include 81-04 mandating participation of EPC ministers and 84-08 mandating benefit eligible ministers and employee’s participation in the denominational plan.

PARTICIPATION OVERVIEW

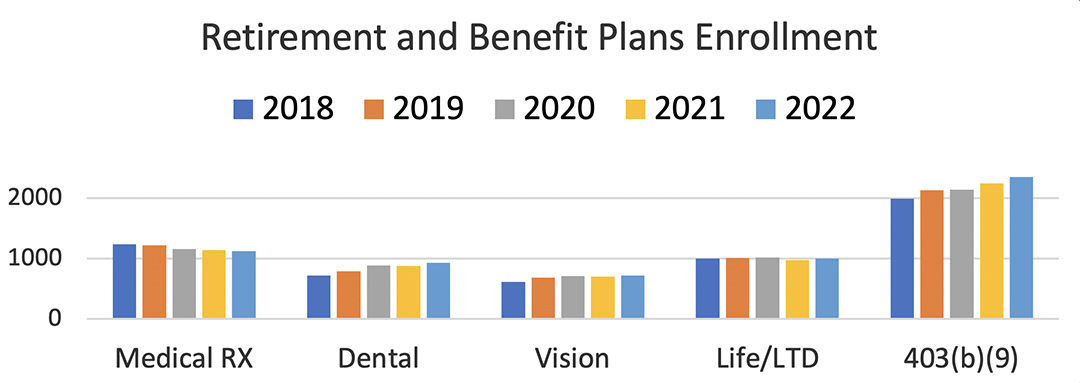

Approximately 3,100 participants are enrolled in the EPC Medical Plan, including 1,121 clergy and staff and nearly 2,000 dependents. A total of 2,346 active clergy, staff, and retirees were enrolled in the EPC Retirement Plan at the end of 2021. The chart below reflects employee enrollments (without dependents) that have been fairly stable for the last five years with our Health and Life benefit plans, with steady participation growth showing in the Dental Plan and the Retirement Plan participation.

All full-time clergy and staff at EPC churches and EPC-associated ministries are eligible to participate in the benefit plans sponsored by BRI. Higher participation advantages all members and their sponsoring churches. If your church has not taken advantage of these important benefit offerings for your clergy and staff, or if you would simply like to explore the benefits offerings and costs, we welcome your inquiry to our Executive Director at 407-930-4507 or benefits@epc.org.

MEDICAL/PRESCRIPTION DRUG BENEFITS

This year we introduced Meritain Health as our new medical plan administrator and changed to the Aetna network of healthcare providers. Meritain, one of the country’s largest employee benefit administrators, was established in 1983 and has 2,550 employees in offices throughout the U.S. Most importantly, Meritain shares the EPC BRI mission of lowering the total cost of healthcare with improving member health.

While the people processing our claims have changed, it is important to note that the coverages our plans offer have not changed. That’s because the EPC Medical Plan is our plan, not a plan we adopted from an insurance company. What’s covered under the plan is controlled by the EPC, and importantly, services and medications that run counter to our beliefs are not covered.

Our membership experienced just a 2% premium cost increase on January 1, 2022, and there were no changes to plan deductibles or co-pays this year. Even with this lower than market premium increase, we are pleased to report that our Medical Plan has a very solid financial foundation, assuring us that our member’s medical expenses are covered. The EPC maintains stop-loss insurance and a $7.3 million medical reserve fund (as of March 31, 2022) that provide a secure backstop for unexpected member claims.

We understand that member EPC churches and staff have varying needs when it comes to medical coverage, that’s why we offer five plans: Platinum, Gold, Silver PPO Plans, plus Gold and Bronze High-Deductible/Savings Plan options. These plans offer a wide spectrum of premium and participant cost-sharing levels.

Twenty-six individuals covered by our plan incurred more than $100,000 each in medical costs during 2021. A health crisis can arise for any of us at any time. A crucial role of the EPC BRI plan is to stand in the gap, so that the health crisis does not also become a financial crisis. Thank God the resources of our plan—made possible by the members and churches who participate in our plan—were there for these families.

In 2021, COVID was again a factor in our claims cost. The plan experienced claims of $1.1M (about 7% of all claims) related to COVID testing and treatment. This is about double the COVID-related claims experienced in 2020. The cost of the vaccine and its administration is being absorbed by the Federal government when a public vaccination site is used; however, as required by law the plan covers the cost of testing and of the vaccine and its administration for all of our members who receive it elsewhere. COVID test kits are now available free at www.covid.gov/tests.

The telemedicine service utilized by the EPC plan is a company called 98point6. During 2021, an increasing number of our members found that service to be helpful. The physicians on call can issue prescriptions if appropriate, and this occurred in 49% of the EPC member contacts last year. This 24/7 service provides a lower cost and more convenient alternative to visiting an urgent care, emergency room, or even a visit to your primary care physician. In fact, 50% of the 439 EPC member “visits” to 98point6 were during the evening and overnight hours. And be assured that the 98point6 physician will refer you to an urgent care facility, emergency room, or to your primary care physician if that is in your best interest.

98point6 is available to every employee and dependent enrolled in the EPC Medical Plan. The visits are free to members except for those in the HDHP plans, who pay only a $5 co-pay. By downloading the app or going to the website referenced on the back of your medical ID card, you can set yourself up to be “visit ready.” Establishing your patient record in advance saves time on your first visit (Which might be at 2:00 a.m. while experiencing a high fever and cough!). More information on 98point6 is available at www.epc.org/benefits/2022medicalplans.

WELLNESS AND MEMBER CARE FOCUS

The health of EPC members is of critical importance to the BRI Board of Directors and the Office of the General Assembly. The overall health of membership directly impacts the cost of healthcare covered by the plan. But much more importantly, the health of our members directly impacts the work of caring for and leading EPC congregations in sharing the gospel!

From viewing de-identified claim data from our EPC membership, we learn the following:

• Most (but not all) of us are getting our annual physical, bloodwork, or other age/gender-appropriate health screenings.

• Cancer treatments are our highest-cost disease and is directly related to the stage when diagnosed. Your annual physical, bloodwork, and screenings are the best way to assure that cancer can be caught as early as possible.

• Mental health continues to be an area of concern. 22% of our membership are either receiving some treatment for a behavioral health-related condition that may include anxiety, sleep disorders, or depression.

• Among our membership, the most prevalent chronic conditions of concern are high blood pressure, high cholesterol, and diabetes. If you have one or more of these conditions, it is imperative that you follow-up with your treatments and screenings. Of particular note is that 41% of our diabetics in the plan are skipping at least some or all of the routine bloodwork recommended, putting them at great risk. And 17% of members with a known heart condition have not had a preventative visit to the doctor over the last year.

As a result of this last point, BRI has implemented the Livongo Whole Person Health program to coach and provide practical resources to those with diabetes, pre-diabetes, and high blood pressure. BRI also has added a Nurse Health Coaching program to provide education and support to participants with other conditions such as chronic pain, high cholesterol, asthma, COPD, heart disease, and kidney disease. These programs are available at no cost to EPC Plan participants. Use the EPC Benefits website or log into your Meritain Health account for information.

You might think that the bulk of our claims are paid for inpatient hospital stays or doctor’s office services, but in fact nearly $4 out of every $10 of claims is paid to hospitals for outpatient services. These are the infusion centers, testing labs, and imaging services that are part of a hospital system. Patients often don’t realize that they have a choice of non-hospital facilities to use for these same procedures that offer equivalent quality of service at lower cost and often in more convenient locations. To make it easier for our members to explore these facility alternatives we have introduced Healthcare Bluebook and Nurse Coaches through Meritain Health. Bluebook can also direct you to highly ranked doctors and hospitals in your area for specific medical procedures when that unexpected diagnosis arises. In many cases, Healthcare Bluebook offers a financial incentive to our members who select one of their recommended highly performing centers of excellence for a variety of medical procedures and surgeries.

Please, make it a personal goal to take advantage of these important benefits during 2022. In order to make sure you do not miss important health management calls from Meritain, we encourage everyone to add Meritain’s main number to their address book: 888-610-0089.

LIFE, VISION, AND DENTAL INSURANCES

Life and Long-Term Disability insurances are provided by The Hartford. Unfortunately, we saw several life and disability claims filed this past year, but it does highlight the value of these coverages.

EPC BRI’s Vision Benefit plan is provided through National Vision Administrators. Coverages and rates for both of these programs remain unchanged from 2021 to 2022.

After enjoying two consecutive years without changes to dental coverages or premium levels, Delta Dental required us to make changes in 2022 to keep pace with increasing network provider costs and utilization. The plan needed an 8% rate increase and changes to the deductible and co-pays that increased out-of-pocket expenses for participants. Enhancements were made, adding a Virtual Consult dentistry tool and BrushSmart oral wellness program.

RETIREMENT PLAN

Overview

As of December 31, 2021, there were 2,346 participants in our defined contribution Retirement Plan, an increase of 101 over the prior year. Collectively, our members held more than $200 million in their retirement accounts, or an average balance of about $86,000 per participant. (December ’21).

Nearly half of the value of members’ accounts is invested in Retirement Target Date (Life Cycle) funds. These funds automatically and gradually reduce members’ exposure to investment risks as they approach retirement. The increasing use of these funds is a positive trend. Effective August 23, 2021, the Board directed our members’ balances and future contributions in Target Date Funds to be switched from Vanguard funds to Fidelity funds. The Board concluded that Fidelity Target Date Funds were very similar to funds offered by Vanguard in investment risk profile, management, and long-term returns but now have lower management fees.

With these and other fund management fee reductions, members are seeing significant savings in asset-based account fees. Asset-based fees are those charged by Fidelity for their record-keeping of the 403(b)(9) plan and by each fund manager. Those fees have been reduced through negotiations by more than 39 basis points over five years—the equivalent of several hundred dollars on the average account. The EPC also incurs expenses to administer the plan. Our first fee increase since 2017 was effective January 1, 2022, to keep up with BRI’s cost of administering the program. With the $18 increase, each account is currently charged an annual fixed fee of $108; with $0 fees or half fees for low-balance account holders to encourage all to start saving, even if it is only a few dollars a month.

In addition to the 12 Target Date Funds, members have the opportunity to invest in a selection of 11 top-rated funds in various asset classes. Another option is investment through the Plan’s self-directed brokerage link where participants may invest in any publicly traded security, adding hundreds more choices. Participants also have the opportunity to “roll over” funds from their personal IRAs or former employer-based 401(k) or 403(b) plan into their EPC Plan account. Employees and Benefit Administrators can check the EPC website or call the EPC Benefits Office for information.

Legislative Changes

Federal regulators occasionally enact legislative changes that can impact plan administration, distribution rules, etc. The EPC Benefit office works closely with its Plan Consultant, the Church Benefit Association, and legal counsel to make sure its Plan documents are up-to-date and reflect current legislation. The Plan document is currently undergoing a periodic review that will result in updates at some point in 2022. The current Plan document is posted on the EPC Benefits website.

Performance

BRI’s Investment Committee meets quarterly with our Retirement Plan consultant to evaluate the performance, expenses, and risk profile of each of the investment options offered under the EPC 403(b)(9) Plan. We feel confident that the funds selected provide the best choices on all three counts. Over a three-year term, two-thirds of our funds have performed better than their marketplace competitors and 22 of 23 of our funds had lower management expenses than their marketplace counterparts.

Because the EPC Retirement Plan is a 403(b)(9) plan, ordained pastors retain the ability to use up to 100% of their annual retirement withdrawals to pay housing expenses exempt from federal income taxes. This continues even into retirement provided the funds were contributed during the pastor’s tenure as minister and have remained in the EPC Plan. This proves to be a significant advantage for EPC pastors over other retirement plans available in the market without this designation.

Fidelity Investments

We continue to partner with Fidelity Investments to administer and advise members on their retirement plan choices. All EPC Plan participants are entitled to receive a free review of their investment choices, portfolio performance, and progress toward retirement goals at any time with an Investment Adviser by calling Fidelity at 800-642-7131 to make an appointment. We suggest each of our members do this at least annually. For an additional fee, members can also utilize Fidelity’s Personalized Planning and Advice (PPA) service, which offers personalized planning, tracking, and recurring update services with consideration toward all of your financial goals and resources.

Conclusion

Approximately 15% of EPC churches do not have any pastor or staff participating in our 403(b)(9) Plan. That may be because they feel they have their employee’s retirement funding taken care of in some other way, or it may be because the employees and pastor are just part-time, or they simply feel they cannot afford it. We encourage the leadership of those churches to reconsider.

• For a pastor to take advantage of the housing allowance benefit in retirement, the plan must be a 403(b)(9) Plan, like the EPC’s Plan. It cannot be simply a 403(b) plan.

• Part time employees are eligible to participate in the EPC Plan and it is a good tax advantaged way for them to save for their retirement.

• The future financial cost of a pastor or staff member’s retirement years is a real cost that should be provided for while they are working. We believe that a church that is not considering this cost now and not helping the pastor/employee set aside retirement funds now is being shortsighted. Our Plan offers 23 carefully selected investment options, and a brokerage link that adds a virtually unlimited array of additional investment choices and free investment guidance from licensed financial advisers.

THE FUTURE

The EPC Benefit plans are in a solid position to provide care and support for our members. Our plans are designed to be a partnership with our churches and members, so we encourage you to take these steps over the next year to ensure our joint success in your heath, wellness, and retirement security:

• If your church does not participate in the EPC Benefit Plans, put that option in front of your leadership by contacting the EPC Benefits office. We are stronger, together.

• Make it a personal goal for you, your family, and your staff to get your annual medical checkup (including bloodwork).

• Follow up with your physician to complete all the recommended health studies/screenings (mammogram, colonoscopy, lung screenings, etc.).

• Add Meritain’s phone number, 888-610-0089, to your phone’s address book so that you don’t miss any messages regarding their recommendations for your healthcare.

• Make full use of the free Wellness, Member Care, and Disease Management resources and programs available to you as a participant in the EPC Medical Plan. Keep an eye out for BRI newsletters and Meritain Health outreaches.

• Set a goal to put 15% of your income away for your retirement. This can be through a combination of church contributions (10% for pastors is required by Acts of the Assembly) and personal payroll-deducted contributions.

• Consider participating in Fidelity’s Personal Planning and Advice fee service. Or at a minimum, contact Fidelity for a review of your 403(b)(9) account fund selections.

• Review the beneficiary designations for your life insurance and your retirement account.

It is a privilege to serve on the BRI Board of Directors. The health and retirement plans we oversee are for the benefit of those who serve Christ in the EPC. I want to thank my fellow Board members for their dedicated service.

RECOMMENDATIONS (DETAILED)

RECOMMENDATION 42-23

That ordained ministers drawing retirement income from the EPC 403(b)(9) Defined Contribution Retirement Plan be allowed to designate up to 100% of their retirement income for housing allowance as permitted by applicable regulations adopted pursuant to the Internal Revenue Code.

Rationale: To do so permits retired, ordained ministers to take advantage of this significant tax benefit in retirement, thereby making more of their retirement income available for living expenses. Adopting this recommendation on an annual basis provides retired ministers with a readily available reference, if asked by tax authorities.

COMMITTEE MEMBERS

Randy Shaneyfelt (Chairman)

RE, Presbytery of the Great Plains

Michael D. Busch

RE, Presbytery of the Alleghenies

Michael Moore

Presbytery of the Central South

Bill Reisenweaver

TE, Presbytery of Florida and the Caribbean

Sandy Siegfried

Presbytery of the Great Plains

William Barnes

RE, Presbytery of the West

Jim Levine

RE, Presbytery of the West

Erik Ohman

TE, Presbytery of the West

Eric Shipton

TE, Presbytery of the Mid-Atlantic

MEETING DATES

July 19, 2021: Video Conference

September 29, 2021: Office of the General Assembly (Orlando, Florida)

December 16, 2021: Video Conference

March 10, 2022: Office of the General Assembly (Orlando, Florida)

June 14, 2022: Video Conference

Respectfully submitted,

Randy Shaneyfelt, Chairman

April 2022

Office of the General Assembly

5850 T.G. Lee Blvd., Suite 510

Orlando, FL 32822

(407) 930-4239

(407) 930-4247 fax

info@epc.org